Trump Trader AI

AI-Powered Automated Trading Software

TrumpTraderAI is forecasting over 1500 financial instruments daily with 98.9% accuracy. Decoding President Trump’s (also every influential politician and CEO) every word and action in order to make profitable trading from the financial markets based on precise technical and fundamental analysis.

Trade smarter, not harder

- Key Support and Resistance levels

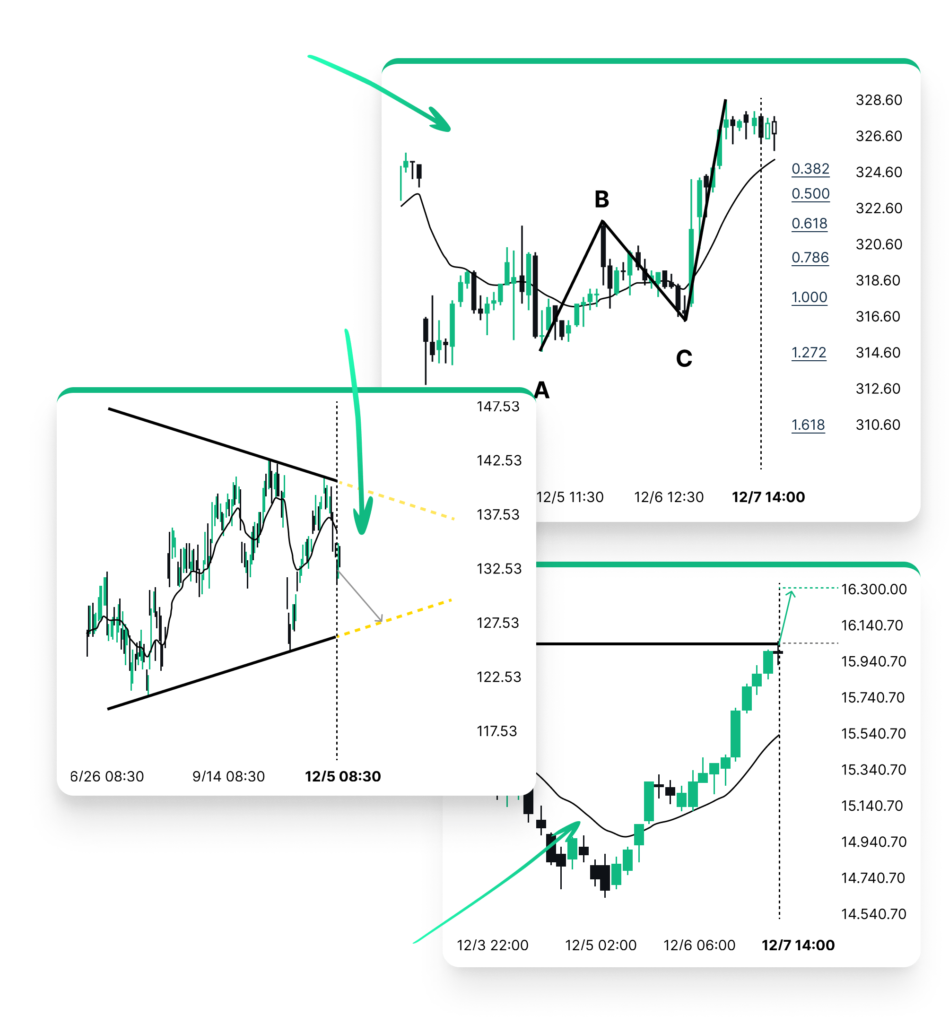

- Technical Chart Patterns

- Extreme Market Movements

- Fibonacci Patterns

- Macro-economic Events

- Market Volatility

- Company Valuations

- News Sentiment analysis

Navigate financial markets with confidence using Cutting-Edge Analysis and Tools.

TrumpTraderAI provides an extensive analytics toolset with features to take your trading to the next level. Empower your day-to-day trading decisions with an unrivalled breadth and depth of analysis driven by advanced algorithms, powerful big-data technology, and user-friendly trading tools.

Technical Analysis

TrumpTraderAI's Technical Analysis examines historical price patterns to reveal potential future movements.

Statistical Analysis

TrumpTraderAI's Statistical Analysis leverages historical and quantitative data to highlight possible market changes.

Volatility Analysis

TrumpTraderAI's Volatility Analysis tracks real-time market fluctuations based on historical data to assess price stability.

Macroeconomic Analysis

TrumpTraderAI's Macroeconomic Analysis explores the global economic environment to gauge potential impacts on market trends.

Fundamental Analysis

TrumpTraderAI's Fundamental Analysis provides a comprehensive assessment of assets to identify their intrinsic value.

Sentiment Analysis

TrumpTraderAI's Sentiment Analysis captures the market's mood, evaluating levels of optimism and pessimism.

Our Process

Step-by-Step to Achieving Your Goals

Initial Consultation

Sign up and get a free consultation to see if you qualify for an AI trading account.

AI Integration

Our experts will help you setup the AI trading account and integrate all systems for you.

Watch It Grow

After the setup is done just sit back, relax and watch your investment grow. Our experts will always update you performance optimization tips.

Why Use Our AI

Beat the markets

Stay always a few steps ahead with our premium AI features.

Unlock Computational Power

Professional analysts can monitor a dozen instruments per day. Autochartist monitors tens of thousands of financial instruments in real time.

Alerts On The Go

Never miss a trading opportunity with personalised alerts for market movements, volatility, and upcoming macroeconomic events.

Minimise Risk

Effectively manage risk and potential overexposure in leveraged markets with Autochartist’s innovative Risk Calculator.

Global Market Coverage

Benefit from our broad coverage of global markets, including stocks, indices, currencies, bullion, metals, commodities, ETFs, options, and cryptocurrencies.

Why Use Our AI

Market Coverage

- Stocks (hourly data for most, 15-minute data for some very liquid stocks)

- Currencies (15-minute data)

- Indices (hourly data)

- ETFs (hourly data)

- Cryptocurrencies (15-minute data)

Highlights

- The Technical Analysis web component is updated every 15 minutes with new trade setups based on all Autochartist analysis types.

- Automatically detects actionable, high-probability trading opportunities.

- Delivers technical trade ideas and setups identified via Technical Analysis.

- Automatically identifies Chart Patterns, Fibonacci Patterns, Horizontal Support and Resistance levels.

- Assists in identifying market trends and reversals.

Sentiment Analysis

Sentiment analysis can provide insight into the levels of optimism or pessimism that can influence market trends. It often involves analysis of news headlines, social media posts, and other data sources to gauge the market’s mood or sentiment towards particular securities or the market as a whole.

News Sentiment

Sophisticated algorithms analyse the tone and content of market news articles from major online news sources. The analysis assigns a sentiment score, usually from extremely negative to highly positive, which can help gauge how this sentiment might affect currency and US stock market prices.

Social Sentiment

This type of analysis often reflects more immediate and raw sentiment data from social media sources and employs algorithms to interpret and classify language and tone to capture consumer attitudes towards certain stocks or markets. Public opinion can guide strategic decisions and identify potential market shifts.

Macroeconomic Analysis

Macroeconomic and economic analyses overlap to identify overarching economic and political events and trends, assessing the various economic indicators and their potential impact on the financial markets. Examples include GDP, unemployment rates, inflation, and monetary policy changes.

Highlights

- Opportunity Display: Traders are informed of real-time market opportunities based on their selected preferences, encouraging exploration across a variety of assets.

- Historical Data Utilization: Guardian Angel uses past trading data to highlight new opportunities.

- View historical data and insights on expected currency movements.

- Comprehensive summaries detailing delta and directional trends.

- Add reminders for high-impact events easily.

Upcoming macroeconomic events

Get an overview of upcoming macroeconomic events that have an impact on the market.

Possible Scenarios

Forecast and Historical Data

Fundamental Analysis

Analyzing the value of an asset considers various factors, including financial and economic factors such as a company’s earnings, profit margins, future growth, and macroeconomic indicators.

Intrinsic value is a concept used in finance and economics to determine an asset’s actual, inherent, or ‘real’ value independent of its current market price.

Stock Valuations

Stock valuations are a vital aspect of fundamental analysis as they help determine whether stocks are overvalued or undervalued. We look at balance sheets, income statements and cash flow statements to gauge the intrinsic value of a stock. Our methodology applies globally accepted valuation methods that are optimised for each stock.

Enjoy Access to Premium Autochartist Trading Tools - Sign Up and Explore for Free Now!

TrumpTrader AI provides an extensive analytics toolset with features to take your trading to the next level. Empower your day-to-day trading decisions with an unrivalled breadth and depth of analysis driven by advanced algorithms, powerful big-data technology, and user-friendly trading tools.